Last month, my friend Nicolas Colin, a Director at The Family, described Europe’s tech IPOs as “boring” in a newsletter. Among other points, Colin argues the need for a deeper ecosystem that links Europe’s entrepreneurs with capital markets. Large IPOs are a big part of this. A debate over the veracity of Colin’s claim spilled into social media, which focused more so on what one considers “boring” than anything else. Word choice aside, I presume that by “boring” Colin meant “small.” On that, he has a point. In both a game of averages and outliers, many of Europe’s most valuable startups have in fact looked to American exchanges for public listings.

How to Tell if You Have Product/Market Fit

This is a debate that will never be settled. Plenty has been written about how to define product/market fit. The consensus seems to be: (a) it’s generally easier to identify when you don’t have it, and (b) when you do, it’s hard to objectively point to why. It’s just a hunch. A feeling.

But, let me propose another way of thinking about it, which comes from my good friend Nicolas Colin of The Family. Nicolas takes a very different approach to helping people thinking about when product/market fit is or isn’t happening, using a story from politics.

Hidden First Rounds

One of the drawbacks of venture capital databases is that they are dynamic. Information trickles in, often with significant time lags. This is especially true at the earliest stages, where rounds are often unannounced and many startups are too small for anyone to notice. It’s a structural challenge that I’m not sure will ever be fully resolved.

The underreporting and time lags associated with very early deals has become further compounded in recent years. Many startups in Silicon Valley and other leading startup hubs have increasingly relied on unpriced rounds (SAFEs or convertible notes) for their first or even second rounds of financing. Because these rounds are unpriced, they don’t appear in a company’s cap table until after it has raised a priced round later (and further, announced the deal—see above).

Combined, there are structural and cyclical reasons that the underreporting of very early venture rounds is especially acute now and fraught with severe reporting delays. This matters because people want to understand the market trends in near real time.

What Does Your City Say?

This morning a friend reminds of a Paul Graham article from 2008 titled Cities and Ambition. It’s excellent. For those of you who don’t know, Paul is the outspoken founder of Y Combinator—a prominent early-stage startup investor in Silicon Valley.

The general thesis of Paul’s article is simple yet elegant. Cities speak to us. They influence our behavior. They shape who we are. It matters where you live. A lot I would argue.

A Second Nobel Prize in Startup Communities

Last year, I wrote about Elinor Ostrom, an American political economist, who was awarded the 2009 Nobel Prize in Economic Sciences for her work on cooperation and collective action. Ostrom studied how rural communities self-organized to sustainably share scarce natural resources in the absence of formalized governance structures. In her Nobel acceptance speech, she described her work in the following way:

“Carefully designed experimental studies in the lab have enabled us to test precise combinations of structural variables to find that isolated, anonymous individuals overharvest from common-pool resources. Simply allowing communication, or “cheap talk,” enables participants to reduce overharvesting and increase joint payoffs, contrary to game-theoretical predictions.”

In other words: we tend to cooperate with people we know, trust, and frequently engage with, while we find it easier to defect or play zero sum games with people we don’t. This thinking is central to building healthy startup communities (or ecosystems), where the flow of ideas, talent, and capital are made possible by informal norms and relationships built on trust, reciprocity, and stewardship. For that reason, I awarded her the Nobel Prize in Startup Communities (credit goes to Victor Hwang for originally connecting Ostrom’s work to startup communities/ecosystems).

WeWork's Collapsing Valuation in Context

WeWork’s calamitous IPO process may have moved into a new phase on Friday, as news reports claimed that the company is considering a valuation as low as $10 billion. That’s a far cry from an initial target of $47 billion—a figure that would match the company’s post-money valuation at the time of its most recent venture financing in January.

A lot has been discussed about WeWork in recent weeks. There are vocal critics who say that the company is a disaster—that it is massively overvalued, its governance practices are irresponsible, and its pathway to profitability is hopeless. Others say that the WeWork is deeply misunderstood and that the company is a disruptive innovation. Some say WeWork is not even a tech company; others say it is.

There is good reason to believe WeWork has a challenging path to profitability, that the company is overvalued, and that its public offering is in jeopardy. I don’t want to rehash all of that today. Instead, I’ll illustrate the (allegedly) remarkable collapse of WeWork’s valuation and place it into a broader context with other companies.

To begin, let’s quickly review WeWork’s fundraising history. The table below shows equity financing rounds beginning with its first seed financing in October 2011 up to the pending initial public offering that was first announced in August. I excluded the $3 billion in SoftBank secondary share purchases and at least $1.8 billion in non-convertible debt.

Included for each funding round are the deal date, amount, post-money valuation, total equity capital raised to date, and invested capital multiple. The “IC Multiple” is calculated as post-money valuation divided by capital raised to date. It can be thought of as a rough measure of gross returns (or capital efficiency if you like) since it’s a ratio between the value of the company and the capital it has raised to get there (“money out / money in”).

As WeWork raised more capital, the company’s valuation grew—and from the beginning through Series E, the valuation grew faster than did the amount of capital going in. This is visualized by the IC multiple, which increased from 3.9x at Series A through the peak of 10.2x at Series E. After that, its valuation continued to grow (numerator), but at a slower pace than the amount of capital going in (denominator)—hence, the falling multiple (ratio). This also meant that, relative to the past, WeWork had to give investors a higher share of the company for each dollar coming in (a lower price).

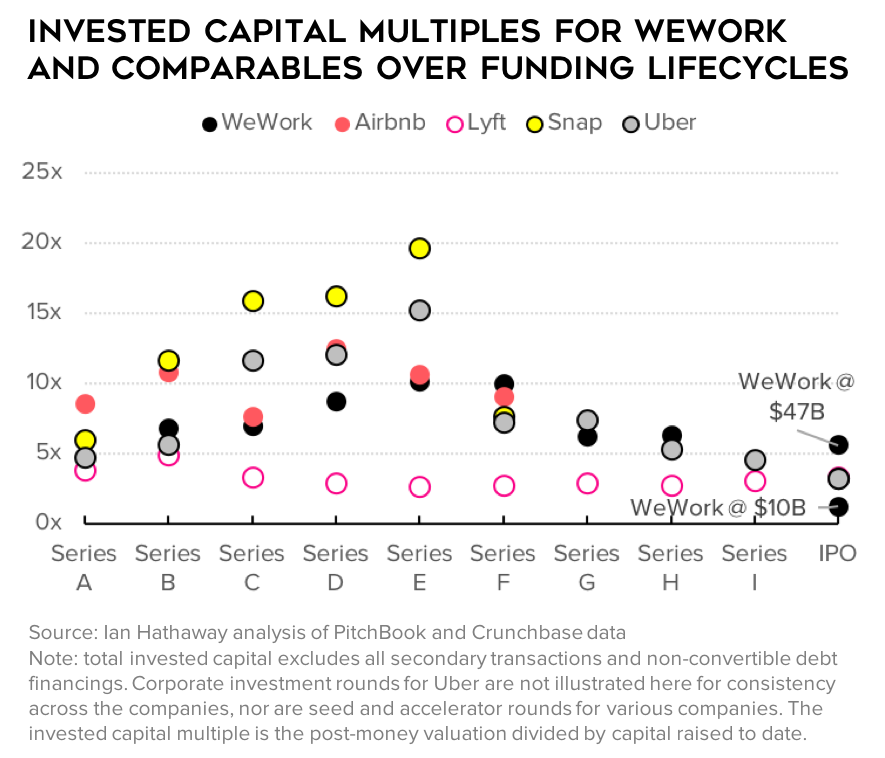

A falling IC multiple is not uncommon among middle-to-late stage companies that raise a lot of capital. To put things into context, here is WeWork’s IC multiple alongside of a few comparable companies—three that went through an IPO already (Lyft, Snap, Uber) and one still privately-held company that is on its way to a public offering (Airbnb).

All but one company follows a similar pattern—growth in valuations that outpace growth in capital invested (an increasing IC multiple) from Series A through Series D-E, at which point things flip as companies raise increasingly more capital ahead of an IPO. Lyft is the exception here as its IC multiple held relatively flat throughout.

So, WeWork’s falling IC multiple on the way to an IPO is not unusual, and in fact, it moved relatively steady compared to both Snap and Uber—both had large drops in IC multiples after Series E, before trending slowly down from there towards IPO.

What’s unusual about WeWork is what’s happening right now. Let’s zoom in a bit from the chart above and look at total capital raised, post-money valuation, and the IC multiple (the ratio of the two) for WeWork under the announced $47 billion valuation, the rumored lower valuation of $10 billion, and the actual figures for the IPOs of Lyft, Snap, and Uber.

The initial target post-money valuation of $47 billion at IPO would produce an IC multiple of 5.6x, making WeWork the star of the group. However, if WeWork were to go public at a $10 billion valuation, then the IC multiple plummets to 1.2x—a middling return over the life of the company. For WeWork to achieve a multiple equal to the three-company average of 3.3x, it would have to reach a valuation of $28 billion. That seems unlikely now.

One question that rises to the surface is: is WeWork is too late in getting public? Given the beating that tech stocks like Lyft and Uber have taken in public markets since their IPOs, it’s fair to ask if investors are simply getting ahead of what’s to come. But even there, WeWork looks like an underperformer overall.

If one were to construct an “alternative IC multiple” which takes market capitalization of each of Lyft, Snap, and Uber today, and places that over their capital raised through IPO, they would still outperform what’s shaping up for WeWork—Lyft’s multiple would fall from 3.3x to 1.8x, Uber’s from 3.2x to 2.4x, and Snap’s would increase slightly from 3.3x to 3.7x. I realize these are not perfect comparisons, but they are directionally correct.

WeWork looks like a company that has been massively overvalued in private markets—particularly of late. Public markets look unprepared to continue that trend. Look no further than this Wall Street Journal article on Friday that shows SoftBank is prepared to prop-up a significant portion of the IPO. That’s wouldn’t happen if investor demand was there. It’s fair to question if the IPO happens at all. UPDATE (Sept 17): hours after this posted, the company announced plans to delay the IPO until at least next month.

WeWork wasn’t always this way. Throughout much of its lifecycle, the company exhibited rather modest growth in valuation to capital injection ratios. That changed dramatically in the last few years as SoftBank started pumping large quantities of equity and debt into the company, and gobbling up shares held by earlier investors and employees through secondary transactions. An examination of the data suggests the final round of financing in January—where SoftBank singlehandedly doubled the amount of capital raised by the company and doubled its valuation—is what may have thrown the whole thing off.

SoftBank, of course, looks like the big loser here. Not only did it single-handedly account for most of the latest-stage capital going into the company through both debt and equity—including the big round in January which may have undermined the entire pathway to a smooth IPO—but it also made a staggering $3 billion in stock purchases via secondary transactions. For more on what that means for SoftBank, read this from Chris MacIntosh.

VC: An American History (Book Review)

Seemingly everyone in my network has been busy the last few weeks reading Secrets of Sand Hill Road: Venture Capital and How to Get It, the highly anticipated book by Andreessen Horowitz partner Scott Kupor that published last month. By all accounts, it’s an excellent guide for helping entrepreneurs and other onlookers understand the practicalities of the venture capital business. I look forward to reading it soon. I, on the other hand, have been focused on a very different type of book on the venture capital industry. VC: An American History is a fascinating tour of the genesis and evolution of the venture capital business, spanning more than 200 years of development. The book was written by Tom Nicholas of Harvard Business School and released just one day before Secrets of Sand Hill Road. I have been eager to get my hands on this book since first learning about it months ago, and I’m happy to say, it didn’t disappoint.

Platforms versus Pipes

One of the biggest challenges facing startup communities (or ecosystems if you prefer) is the inability of “feeder” organizations—such as governments, economic development authorities, corporations, and universities—to engage with an entrepreneurial mindset. The reason is simple: startups and startup communities are organized through networks. Feeders are structured around hierarchies.

Accelerated Companies at Series A

Follow Your Ikigai

Over the weekend, I first learned about the Japanese concept “Ikigai” (eee-kee-guy), which translates to “reason for being” or “reason for living.” I was immediately captivated by the image and the construct. I just spent all of last week on a work retreat of sorts with two dear friends and we talked a lot about deep, life’s purpose kind of stuff. So, my discovery of the Ikigai concept could not be better timed. After sitting with it today, this framework has given me remarkable and immediate clarity into what is causing me angst in my working life at the moment.

It's been a record quarter for European VC investment

If You Want to Better Understand Startup Communities, Read These Three Women

I’m working hard on The Startup Community Way this week with my co-author Brad Feld. As we’re polishing up the meaty part of the book—which draws on a wide range of theory, empirics, frameworks, and just some really brilliant thinking on the part of the many impressive shoulders this work stands upon—a few names keep coming up in the references we’ve assembled.

Three of these names I want to talk about today are intellectual giants in the areas of entrepreneurship, geography, and cooperative social systems. Their work collectively intersects in a way that explains a lot about why startup communities exist. If you want to understand startup communities, you should know their work. Two of them I consider friends, so not only do I get to benefit from their insightful work, I also know there’s a kindness and generosity behind their ideas. The third is not someone I knew, and sadly she’s already passed. But, I think a lot of her work and I’ve written about it already.

All three are women.

Silicon Valley VCs are investing more in European startups

Silicon Valley investors are growing increasingly interested in Europe. That’s the main takeaway from this Sifted Chart of the Week. Last year was a record year for fundraising by European startups with €20.5bn (£18.1bn) spread over more than 3,300 deals. And it came with an increasingly US flavour.

The 1% (of VC)

In the last year, I have written about the increasing size of venture capital deals across the round stages (see here, here, here, and here). Today I’ll take a closer look at that the top of the distribution by examining the share of venture capital dollars in U.S. startups captured by the largest one percent or five percent of deals each year.

The analysis shows that in spite of the impressive growth in venture capital deployment across all deal sizes in recent years, the biggest deals are driving the trend. The largest five percent of deals now account for more than half of venture capital deployed—twice as much was the case just a decade and a half ago. In the last few years, the trend has been driven entirely by the top one percent.

Why Content-Driven Strategy is Smart Business

My friend Nicolas Colin has an excellent new article out titled “Content-Driven Strategy,” in which he makes a convincing case for thoughtful content as a means of demonstrating and shaping the strategic direction of businesses. Nicolas would know: a robust content-driven strategy has been foundational to the success of The Family—the early-stage investment firm he co-founded with Oussama Ammar and Alice Zagury in 2013. What started out in Paris, The Family is expanding rapidly throughout Europe, with offices in London, Berlin, Brussels, and more surely to follow.

I am a strong believer in content as a means of more fully developing thoughts, stimulating discussion, and attracting potential collaborators. Some American entrepreneurs and investors do take content seriously, but many more don’t. That’s a big missed opportunity. The Family has something to teach us Americans on this front, and Nicolas’s article lays out the many reasons why producing content adds value. I encourage you to read the whole article yourself (as well as The Family’s Scaling Strategy series), but here is a summary.

How Change Happens

I recently picked up a copy of How Change Happens: Why Some Social Movements Succeed While Others Don't, a book out last year by Leslie Crutchfield. I immediately became interested in the title because of my upcoming book The Startup Community Way, which will be out later this year. That interest came from the fact that our book (I’m co-authoring it with Brad Feld) is really about a special type of movement-driven social change—one built around local entrepreneurship. How Change Happens is the product of many years of research by Leslie and her team studying a wide range of social movements in the United States—from gun control, to same-sex marriage, to smoking, to drunk driving, to acid rain reduction, to vaccination, and beyond—and systematizing why some succeed while others fail. Dissecting these major movements case-by-case, Crutchfield and her team were able to uncover some interesting patterns about what works and what doesn’t. As I was reading the book, I had in the back of my mind “how do these social movements apply to building startup communities?” I’m glad I did, because it helped crystalize a few ideas I in my head.

Which cities lead the nation for women founding venture-backed startups?

How venture capital mega-rounds obscure improving gender diversification of startup founders

Today, I’m going to publish headline numbers of venture capital investments ($) by founder-gender type. I’m doing this for two reasons. First, while my study provided some important new information, headline numbers of capital invested is what clicks in most people’s minds for “what’s going on” (I disagree). Second, I want to point out that looking at headline numbers of capital investments might obscure a truer picture of a diversifying founder base because giant funding rounds are dominating VC markets.

To test this idea, I pulled annual figures for venture capital deals and capital invested by round size (<$50M, $50M-$99M, $100M-499M, and $500M+) and gender dynamics of founders (women-only, mixed gender, and men-only). What my analysis shows is that mega-rounds ($100M+) are male-dominated and drowning out some promising gender diversification going on for companies in-line with historical venture capital activities.

Women-Only and Mixed-Gender Founding Teams are Driving New Venture-Backed Startup Activity

Two weeks ago, I published a new report for the Center for American Entrepreneurship, titled The Ascent of Women-Founded Venture-Backed Startups in the United States. I followed-up with a summary on this blog last week.

One criticism of the report is my definition of “women-founded”. For reasons I explain in detail in the report’s methodology, I chose “women-founded” to indicate a company that has at least one verified female founder. That means it includes startups with all-women founding teams and teams with both women and men (coincidentally, it also means that I assume that companies with missing founder information had no women founders—more on that in a second). A key reason for not separating these groups was needing a bigger pool of companies to draw from in order to credibly track outcomes over time—and there just weren’t enough of them in the mid-to-late 2000’s to do that. There were tradeoffs.

However, that does not prevent me from more narrowly segmenting these groups here and demonstrating first financing trends only across the four types of founding teams in the dataset—women only, men only, mixed gender, and missing gender. To begin, the first chart here displays the raw numbers of annual first financings for startups falling into each of those four founder-gender categories.

How to Build a Successful Startup Ecosystem in your City

Techstars recently launched a Startup Ecosystem Development offering, which is designed to work alongside of communities around the world to help them build a more vibrant environment for entrepreneurship. The program has been in an R&D/beta-launch phase the last couple years, but the first official program will take place in Buffalo, New York over the next three years.

Yesterday, to introduce the program and answer questions about what they’re up to, Chris Heivly (who leads Ecosystem Development at Techstars), Brad Feld (author of Startup Communities and a Techstars co-Founder), and Eric Reich (chairman of 43 North, the startup support organization in Buffalo that is partnering with Techstars to lead the effort) participated in an hour-long segment on Crowdcast.

I embed the event below and encourage anyone interested in the topic to give it a listen—it’s definitely worth your hour and is full of wisdom and insights from these three.